Important Update for Personal Insurance Customers:

Flood Insurance

We are pleased to announce that we have implemented an enhanced customer service process that will allow our customers to receive faster response times and more efficient service. Our priority is to provide you with exceptional service. Read the full update.

Flood Insurance

If you can’t predict or prevent a flood, then how do you make sure you’re prepared?

If you live in Western Massachusetts, that means you are definitely not a stranger to unpredictable New England weather. As homeowners, renters, and business owners we’ve all gotten used to – or at least come to expect – nasty blizzards, wicked downpours, and shingle-rattling winds throughout the four seasons.

However, just because we are familiar with harsh weather, doesn’t necessarily mean we are always fully prepared for a storm to hit us. When extreme weather comes, there are the inevitable interruptions to our lives and, sometimes, unavoidable damage to our homes and property. Perhaps the most unpredictable source of this damage are the flood conditions that can arise during and after severe storms.

Flooding occurs in our area for a variety of reasons, including some that might surprise you:

- A winter ice jam frozen in place in one of our many local rivers can cause water to overflow, particularly if it starts to melt or if there is a heavy rain

- The arrival of warmer temperatures shortly after either a large snow or a period of freezing temperatures can lead to rapid snow and ice melt, rising rivers, and flooding streets and basements

- Heavy spring rains can cause brooks, lakes, ponds and other bodies of water commonly found in Massachusetts to reach street level and cause dangerous flooding and driving conditions

- Hurricane-like winds in autumn can cause leaves to fall at a much quicker pace than normal, blocking surface water drains outside of your property and creating a major flash flood risk

With so many of our homes sitting within miles of New England’s longest and largest river, the Connecticut River, and on the doorstep of so many other equally scenic – but risky – bodies of water, like the Mill River, South Hadley Falls and Canal, and Quabbin Reservoir, we should all be taking the likelihood of flooding, any time of year, very seriously.

Why HUB International recommends you consider flood insurance

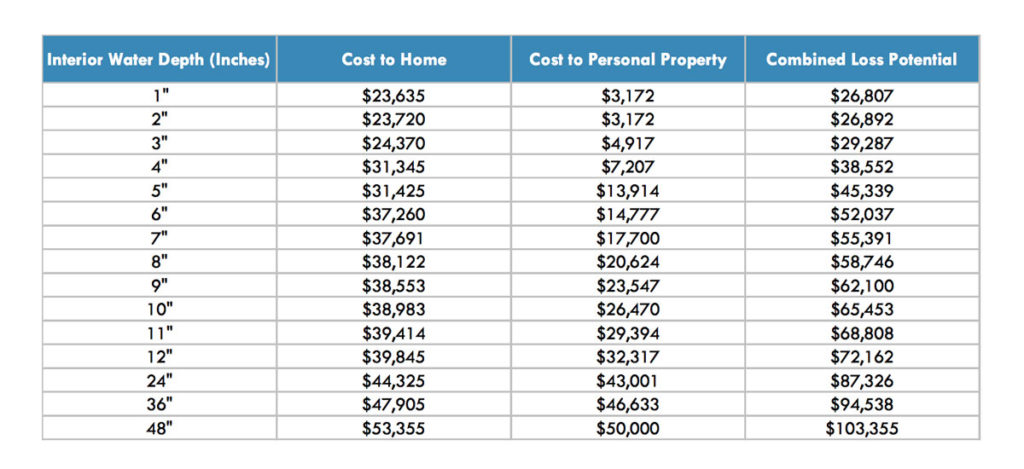

It should come as no surprise, floods are extremely costly. According to the Federal Emergency Management Agency (FEMA), recovering from damages caused by flooding can be expensive, regardless of whether you end up having to repair your home, or replace it entirely along with all its contents. FEMA estimates that the average home experiences $27,000 or more in losses when it is flooded with just one inch of water. Whereas, a more serious flood can cost average homeowners hundreds of thousands of dollars or more.

However, if you have the proper flood insurance policy, physical damage to your home and personal property would be covered, up to the policy limit. Maybe you think that you’re fine without flood insurance because you have homeowners or renters insurance. But, in reality, most standard home and renters policies do not include any coverage for flood.

We recommend that you speak with your HUB International agent as soon as possible to understand what your current policies cover and to discuss why flood insurance might be an important asset to have. In the meanwhile, we wanted to share what the typical flood insurance policy does cover:

Covered types of property

- Electrical and plumbing systems

- Furnaces, water heaters, heat pumps, and sump pumps

- Refrigerators and cooking stoves

- Built-in appliances

- Permanently installed carpeting over an unfinished floor

- Permanently installed paneling, wallboard, bookcases, and cabinets

- Window blinds

- Foundation walls, anchorage systems, and staircases

- Detached garages

- Cisterns and the water in them

- Fuel tanks and the fuel in them

- Solar energy equipment

- Well water tanks and pumps

Covered types of content

- Personal belongings, such as clothes, furniture, and electronic equipment

- Curtains

- Portable and window air conditioners

- Portable microwave ovens

- Portable dishwashers

- Carpets not included in building coverage

- Clothing washing machines

- Clothing dryers

- Certain valuable items such as original artwork and furs (up to $2500)

- Food freezers and the food in them

It’s important to remember that this is just a summary of what is generally covered in a flood insurance policy. Scheduling a meeting with your insurance agent is the only way to make sure you understand what is actually covered, up to what limits, and, more importantly, what is not covered.

HUB strives to do more for you when it comes to flood protection

Your HUB International team would like the opportunity to take you through our flood risk assessment process, which will not only include a review of the Federal Emergency Management Agency’s (FEMA) flood map system, but also the specific landscape, drainage and structural conditions of your property. Our professionals are here to provide assistance for new coverage, to review your current flood insurance policy, to answer questions you might have about your flood risk, or to simply help you understand how to better protect your home, your belongings, and your family from the possibility of a flood event.

If you are ready for a more personal relationship with a trusted insurance professional who cares about safeguarding everything under your roof, call us today at 833-GoCallHUB or visit us at either of our two convenient Massachusetts locations.

Get a Quote

Please fill out the form below if you are in need of an insurance quote. A member of our team will be in touch with you shortly.